The biggest excuse for not investing I hear is: “I have no money to invest.”

Part of the reason why people think they should hold back from investing until they have more money is that they think it’s risky.

They don’t know when to buy, what to buy, or sometimes how to buy.

Here is the main issue with that.

Nobody knows when a market goes up, down, sideways. Anyone who tells you they do is either lying, foolish, or both.

And having tons of cash will not give you that kind of expertise.

Solution?

Instead of striking one magical moment, buy regularly and consistently over a long period.

The fancy name for this is “compound interest.”

When Albert Einstein once said that humanity’s greatest invention is “Compound interest.”

He also called compound interest the “eighth wonder of the world” and stated that “He who understands it earns it; he who doesn’t, pays it.”

Compound interest is basically “interest on interest.”

It simply means saving early and letting investment compound over a more extended period.

It’s quite a liberating strategy, and it takes the pressure off needing to pick the right instant to buy.

In my view, it’s as close to financial magic as you can.

And on top of that, with this strategy, you are almost sure to put $1 million in your pocket.

The magic is in the simplicity of this strategy. It’s all about investing repeatedly and long enough to ignite the miracle of the compound effect.

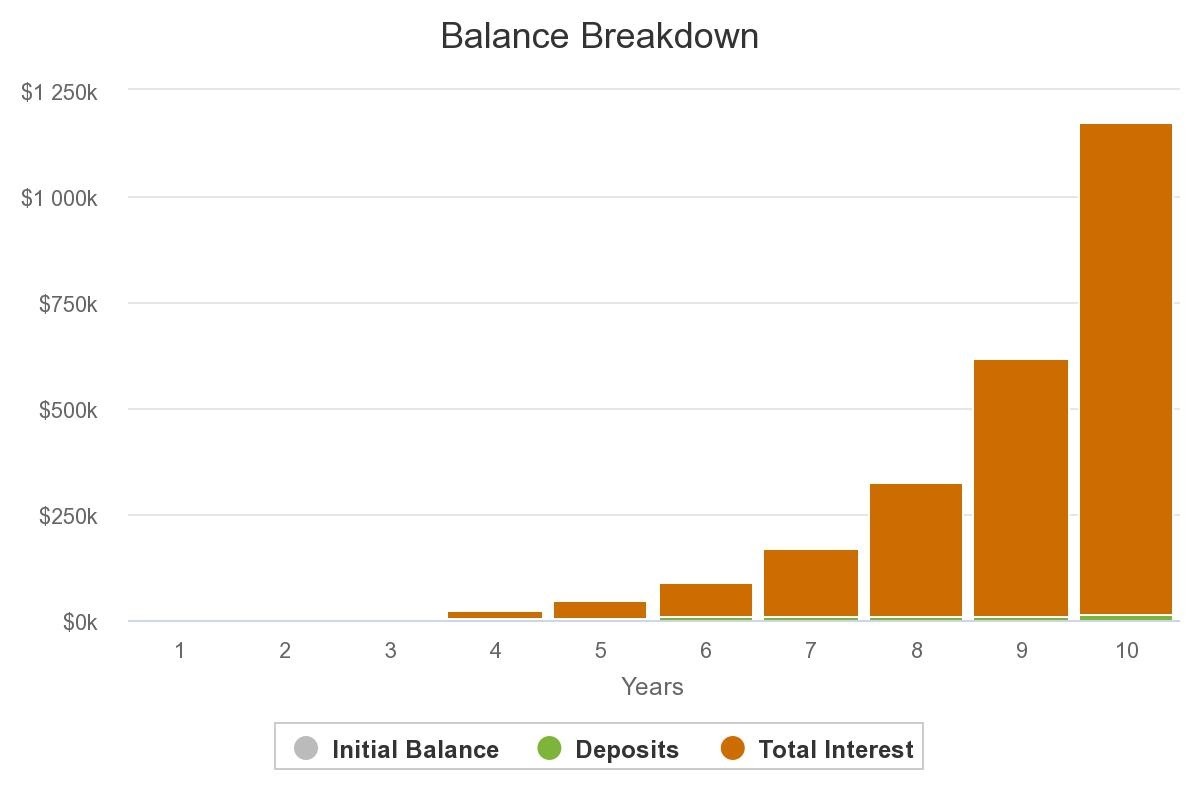

For example, assume you put $100 per month into Bitcoin.

In 10 short years, your $12,000 invested will be worth $1.163 million. Yes, that’s million, with six zeros. Check out the compound calculator and play around with the numbers for yourself.

But are these expected returns realistic?

Based on historical data, they sure are.

Cathie Wood and her ARK is the most successful fund in the last five years. According to their research, Bitcoin’s return in the previous seven years was 90 percent. It’s one of the best-performing assets in a decade.

Yes, it’s that simple.

And you don’t need a big pile of cash to invest. With this strategy, you can dip your toes into the water and learn as you go.

This passive form of investing means you don’t try to buy or sell based on your research. Also, you never panic when the market crashes, but you’ll only lock in your temporary losses.

The magic is not in the complexity; the magic is in the doing of simple things repeatedly and long enough to ignite the miracle of the compound effect.

But as Jim Rohn would say, “What’s simple to do is also simple not to do.”

You have to take action. You’ve got to invest money to make money.

Because the biggest difference between successful investors and unsuccessful investors is successful investors are willing to do what unsuccessful avoid.