Are you sick and tired of hearing that the 60% stock and 40% bond portfolio a proper diversification?

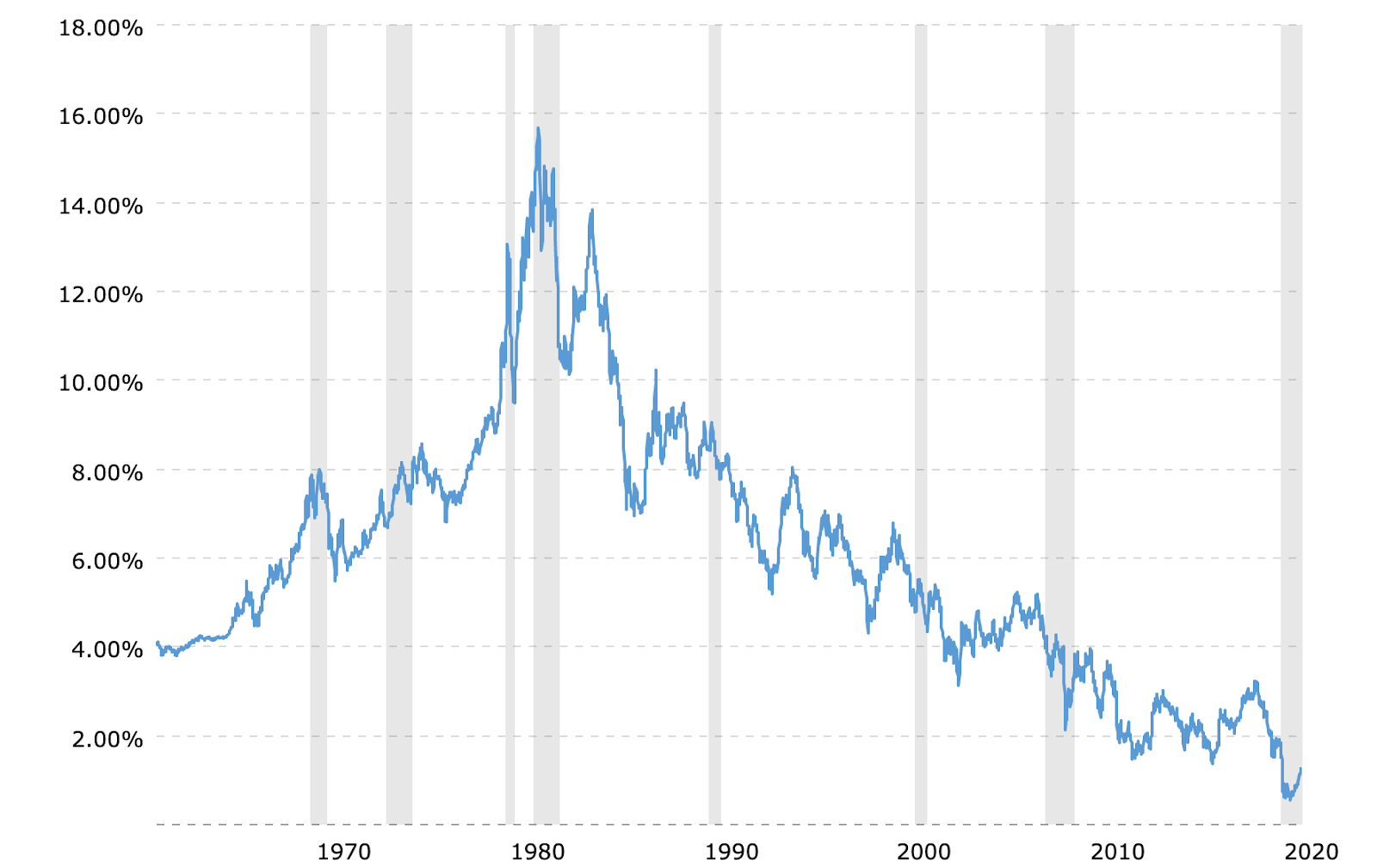

I get it. According to data, if you invested in a 60/40 portfolio at the beginning of 2011, you barely made any profit on your 40% portion. While stocks produced a gain of 14.1%, assuming you invested the stock portion in the S&P 500, the bond portion produced only 3.7% annually.

So should retirees and long-term investors continue to have faith in the 60/40 portfolio?

No. They should give up on bonds for a variety of reasons.

Bonds offer more risks than reward

For starters, it’s helpful to review why does your advisor urge you to have a bond allocation in the first place.

When it comes to diversification, financial advisors often turn to the 60/40 model to build their portfolio. The goal of investing 60% in equities and 40% in bonds is to eliminate portfolio risk. In other words, to avoid putting all your eggs in one basket.

Historically there has been a low correlation between stocks and bonds. In essence, when bonds go up, stocks go up, and vice versa. Your advisor is only trying to lower volatility or risk.

Here’s is the main issue with that.

Bonds lower the risk of your portfolio only by losing your money. We’ve seen backed by data during the last decade. Since 2011, on average, US bonds have compounded 3.7% annually. And there no sign that this trend should continue during this decade. With %

$3.3 trillion printed in 2020 and an impending $1.9 trillion stimulus package, quantitative easing is just getting started. Above all, Fed promised to keep interest rates near zero till at least 2023. So be sure to expect the yields to go even lower.

Bonds are a terrible idea during inflation.

I can almost hear you thinking. The return of 3.7% is not a loss.

Yes, it is. Here’s a catch.

The dollar is continuously debased by money printing. The question is by how much. Well, if you take CPI as your primary inflation measure, you might get an impression that the prices have not grown by much. The problem with CPI lies in its calculation.

The measurement is entirely wrong. I’ve written about it previously. The CPI is basically a government tool to manipulate the currencies as they see fit. One of the main reasons the CPI is wrong is that it doesn’t count the home prices. Unless you’ve been living under a rock for the past 20 years, chances are you’ve seen real estate prices double or triple regardless of which country you live in. However, the CPI doesn’t count the home prices in its measurement.

Fortunately, we now have a more accurate measure of inflation. It’s called The Chapwood Index. And according to this index, average inflation over the last five years was between 8.1% and 12.9% in the top 10 U.S. cities.

In short, when adjusted for real inflation, bonds are simply guaranteed to lose money in exchange for low volatility and correlation. If we take the real inflation rate in consideration, investors lost 5-9% annually on their 40% portion of your portfolio. And the same will apply to the current decade. With bonds, they are taking much more risk with fixed income than the reward you are given. It’s like picking up a penny in front of a steam roller.

Consider alternatives to bonds

It’s also important to remember that the original message of dividing risk two ways between stock and bonds was brilliant.

But it is no longer the case. The world has changed. The question is no longer, “Should I own bonds or should I not?” There are many other asset classes that you can put in the portfolio that provide higher yield, lower correlation to equities. Among some are assets such as real estate (REITs), gold, commodities, and, let’s not forget, the best performing asset class in the decade, cryptocurrencies.

The bottom line?

Give up on your 60/40 portfolio. It’s dead as a doornail, and it belongs to the last century.

And while you at it, drop your advisor that suggested you buy bonds. Here’s is the main problem with financial advisors. Rather than doing what is best for the client, financial advisors often do the thing that is least likely to put their job a risk.

Instead, choose advisors who have taken the time to educate themselves and dare to think independently. Smart advisors wouldn’t keep 40% of their clients’ portfolios in guaranteed negative real rate bonds.

In the era of quantitative easing and zero-interest rates, you will have to step out of your comfort zone to realize significant gains.

As Rober Arnott said, “In investing, what is comfortable is rarely profitable.”